Things about Broker Mortgage Fees

Wiki Article

Excitement About Broker Mortgage Meaning

Table of ContentsThe Best Guide To Mortgage Broker Job DescriptionMortgage Broker Salary - TruthsNot known Facts About Mortgage BrokerageBroker Mortgage Meaning Fundamentals ExplainedMortgage Broker Salary for DummiesAbout Mortgage Broker SalaryThe 6-Second Trick For Broker Mortgage Near MeSome Known Details About Mortgage Broker Average Salary

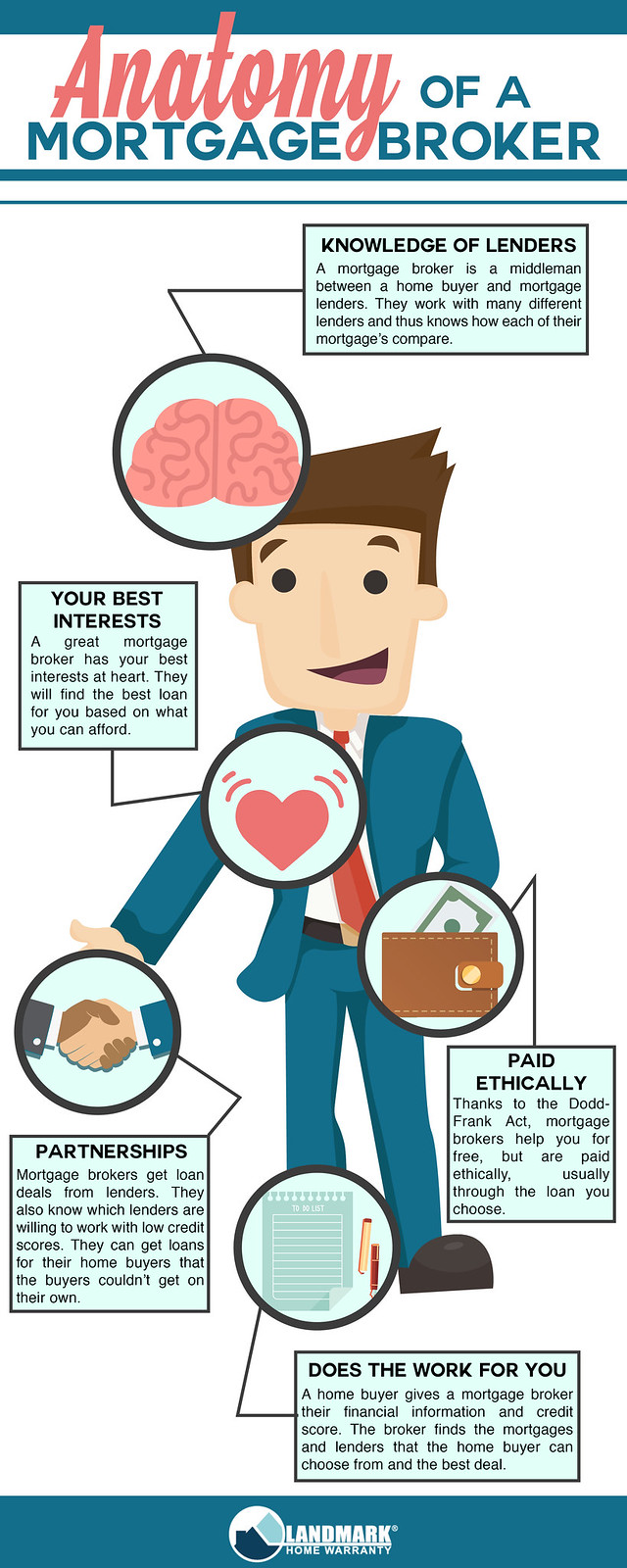

What Is a Home loan Broker? A home loan broker is an intermediary between a financial organization that supplies lendings that are secured with property as well as people interested in buying realty who require to borrow money in the type of a loan to do so. The home loan broker will certainly function with both celebrations to get the individual authorized for the financing.A home mortgage broker typically functions with various lending institutions as well as can use a range of financing choices to the consumer they function with. What Does a Home loan Broker Do? A home mortgage broker aims to finish realty transactions as a third-party intermediary between a consumer and also a lender. The broker will collect information from the individual and also go to multiple loan providers in order to locate the finest potential finance for their client.

The Ultimate Guide To Mortgage Broker Meaning

All-time Low Line: Do I Required A Mortgage Broker? Collaborating with a home mortgage broker can save the consumer effort and time during the application process, as well as potentially a great deal of money over the life of the car loan. On top of that, some lenders function specifically with home loan brokers, indicating that debtors would certainly have access to lendings that would otherwise not be available to them.It's critical to check out all the fees, both those you might need to pay the broker, in addition to any charges the broker can assist you avoid, when weighing the decision to work with a home mortgage broker.

Not known Incorrect Statements About Mortgage Broker Meaning

You've probably listened to the term "home loan broker" from your property agent or pals who have actually acquired a residence. What precisely is a home mortgage broker as well as what does one do that's various from, state, a car loan officer at a bank? Nerd, Purse Guide to COVID-19Get answers to inquiries regarding your home loan, travel, finances and keeping your satisfaction.What is a mortgage broker? A home loan broker acts as an intermediary between you as well as potential lenders. Home loan brokers have stables of lenders they work with, which can make your life easier.

Some Ideas on Mortgage Broker Job Description You Need To Know

Exactly how does a home mortgage broker obtain paid? Mortgage brokers are most commonly paid by loan providers, sometimes by customers, however, by legislation, never ever both.What makes mortgage brokers various from finance police officers? Financing officers are workers of one loan provider that are paid set salaries (plus perks). Finance police officers can compose only the kinds of finances their employer selects to supply.

Our Mortgage Broker Association Ideas

Home loan brokers may be able to provide customers access to a wide choice of finance types. You can conserve time by using a mortgage broker; it can take hrs to apply for preapproval with different lenders, after that there's the back-and-forth communication you could try these out involved in financing the car loan and guaranteeing the purchase remains on track.However when picking any kind of loan provider whether via a broker or directly you'll wish to take note of lending institution costs. Especially, ask what costs will appear on Web page 2 of your Funding Estimate form in the Loan Costs section under "A: Origination Charges." Then, take the Funding Estimate you receive from each lending institution, place them side by side as well as contrast your Go Here rate of interest and all of the costs as well as closing costs.

The Best Strategy To Use For Mortgage Broker Average Salary

5. How do I select a home loan broker? The very best method is to ask good friends as well as relatives for recommendations, however ensure they have actually used the broker as well as aren't just going down the name of a previous university flatmate or a remote acquaintance. Learn all you can regarding the broker's solutions, communication style, level of expertise as well as technique to clients.

Facts About Mortgage Broker Meaning Revealed

Competition and also residence prices will certainly affect exactly how much home mortgage brokers get paid. What's the distinction between a home loan broker and a finance policeman? Funding officers work for one lending institution.

About Broker Mortgage Rates

Acquiring a new residence is just one of the most complex occasions in a person's life. Quality differ substantially in terms of design, services, school area and, naturally, the always important "area, location, place." The home loan application procedure is a complicated element of the homebuying procedure, specifically for those without past experience.

Can figure out which problems may produce problems with one lending institution versus another. Why some customers avoid mortgage brokers Often homebuyers feel more comfortable going directly to a big financial institution to secure their financing. In that situation, purchasers must a minimum of talk with a broker in order to recognize all of their alternatives regarding the kind of funding and the offered price.

Report this wiki page